𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "So in simple terms, the implied repo rate is the implied money market return from a cash and carry trade. And for a treasury futures seller, that

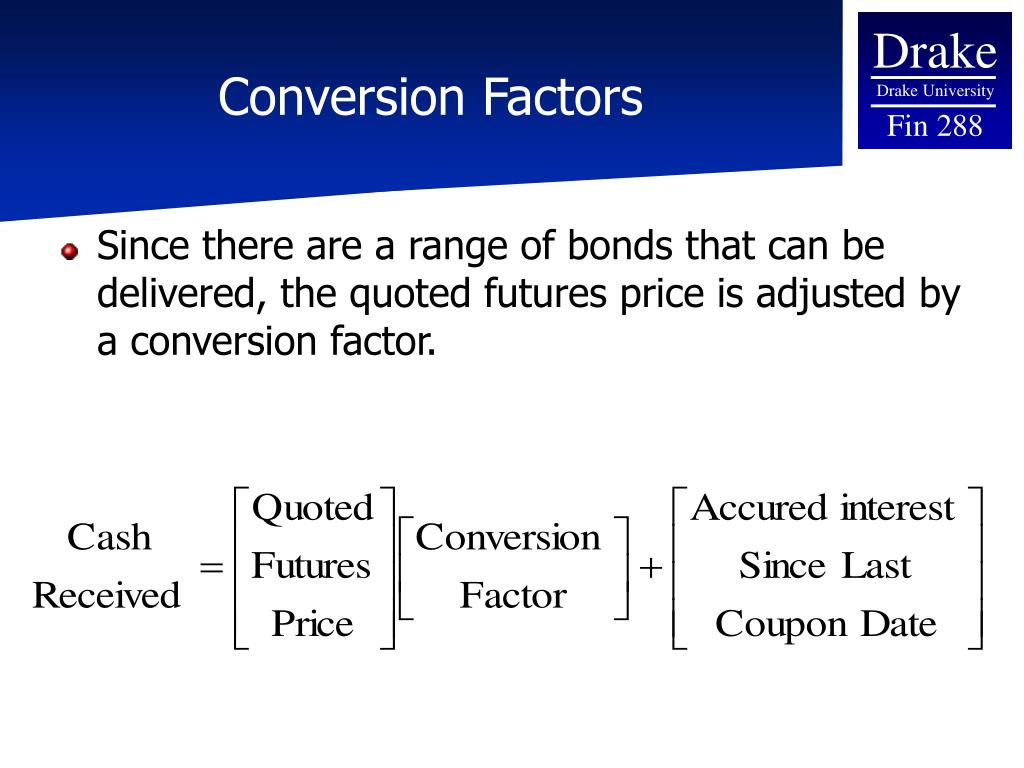

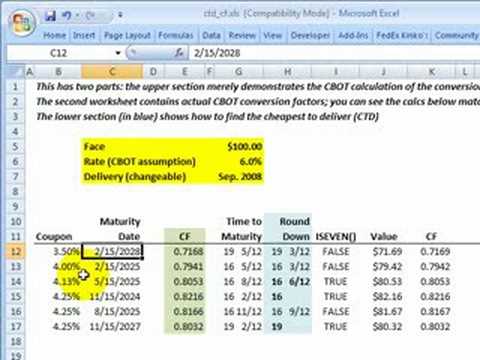

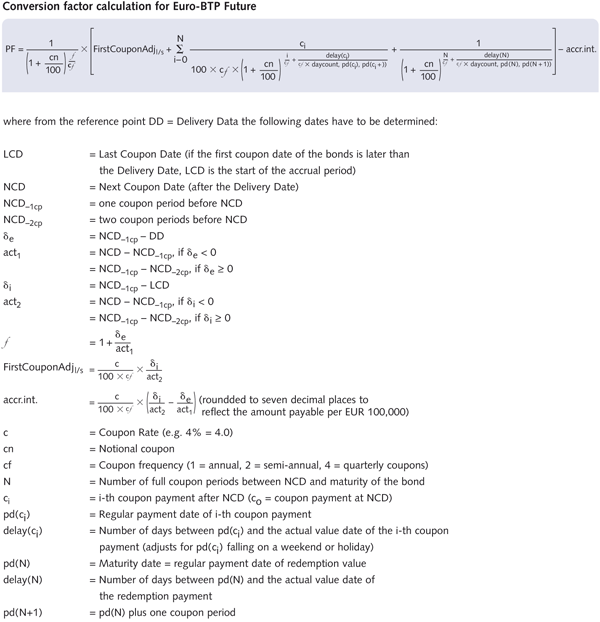

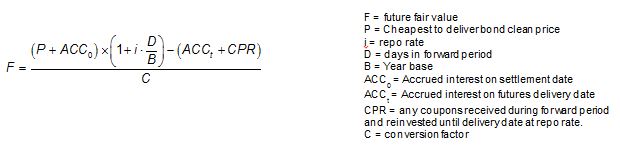

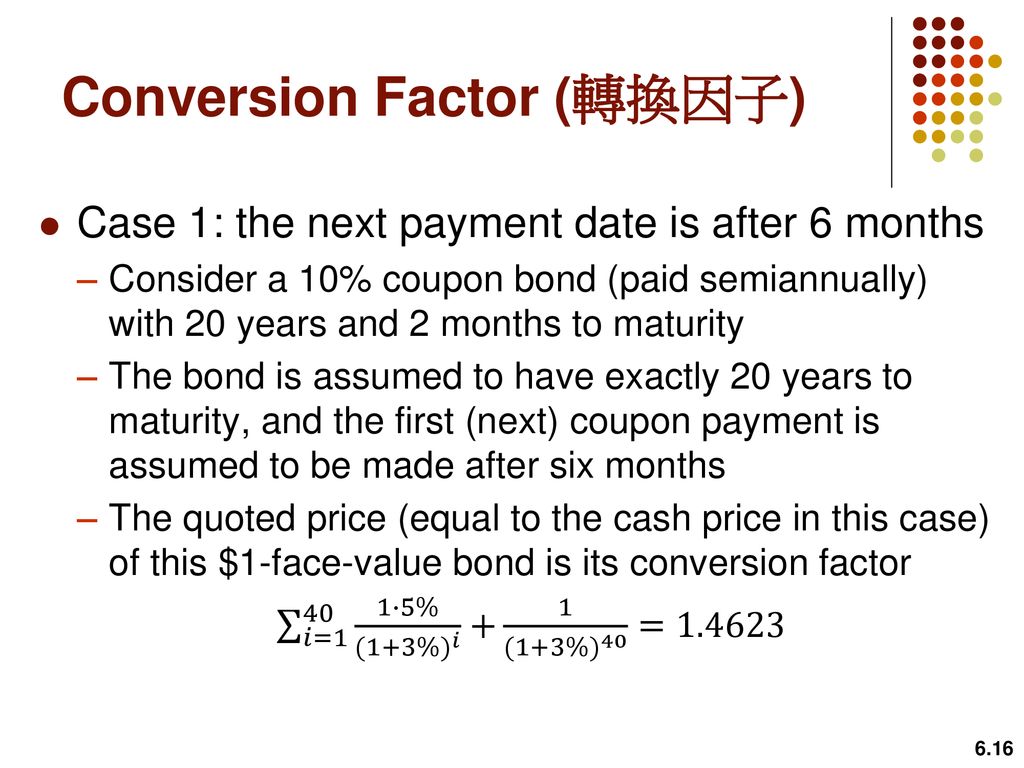

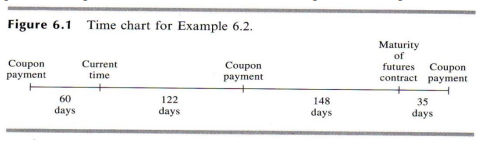

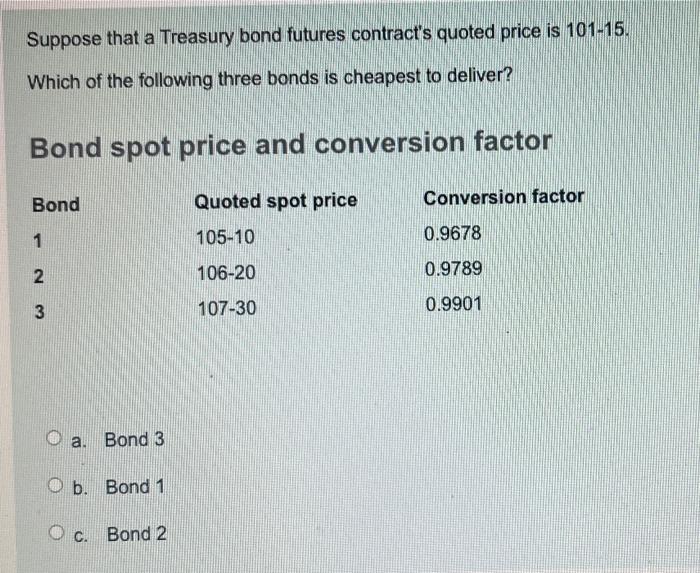

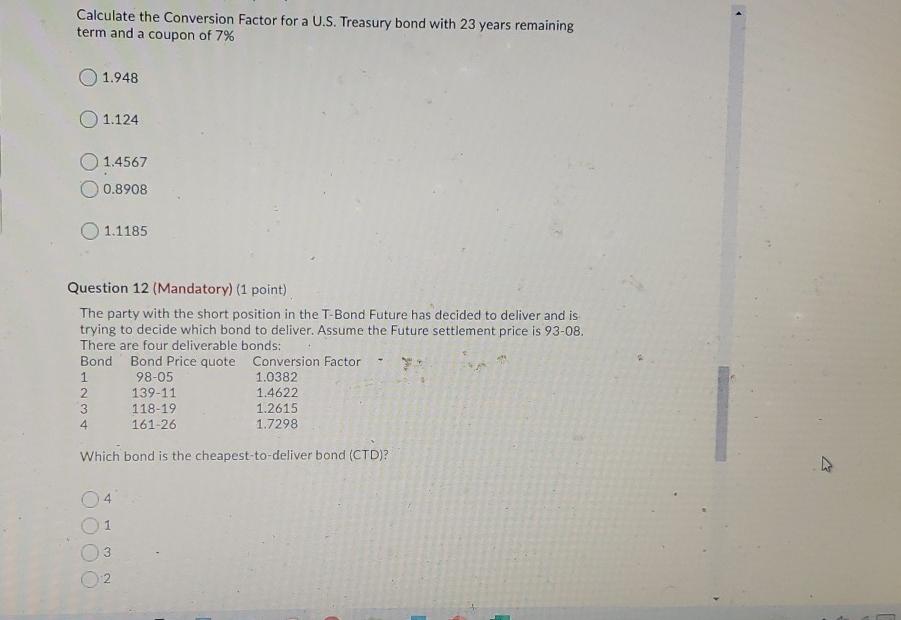

Lecture 11. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

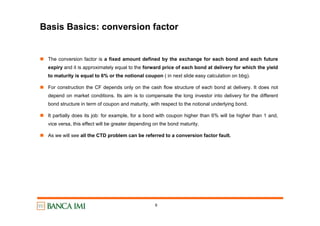

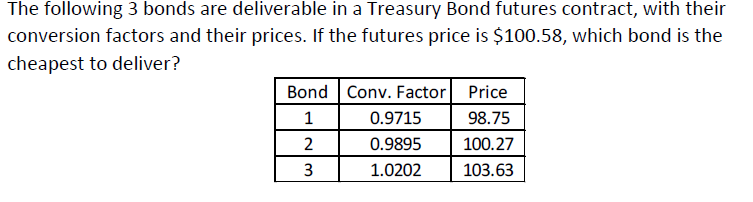

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "The CTD's risk value of 6.976 is then divided by the conversion factor 0.8338 to arrive at 8.367 which is the price risk of the future based

Lecture 11. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download